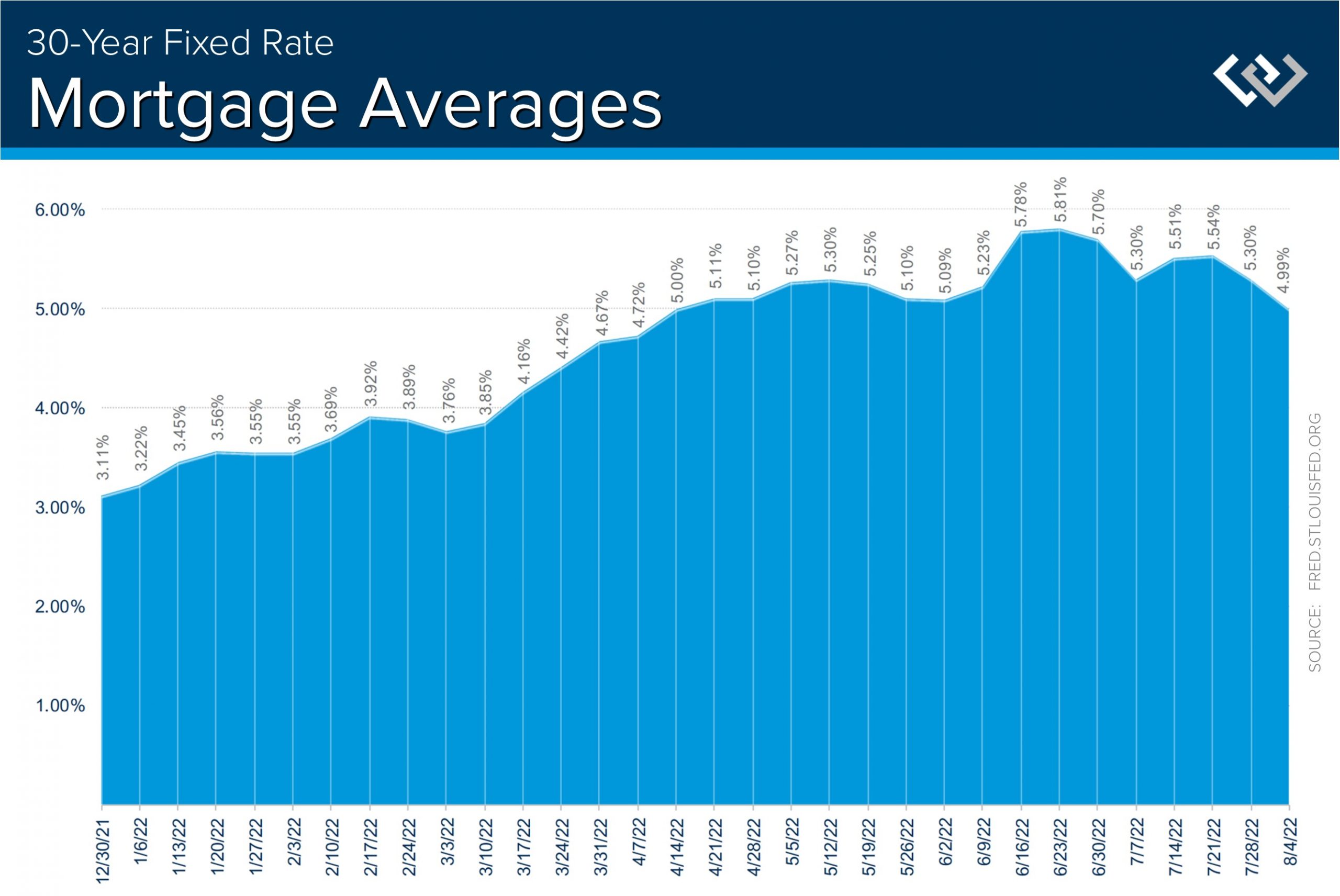

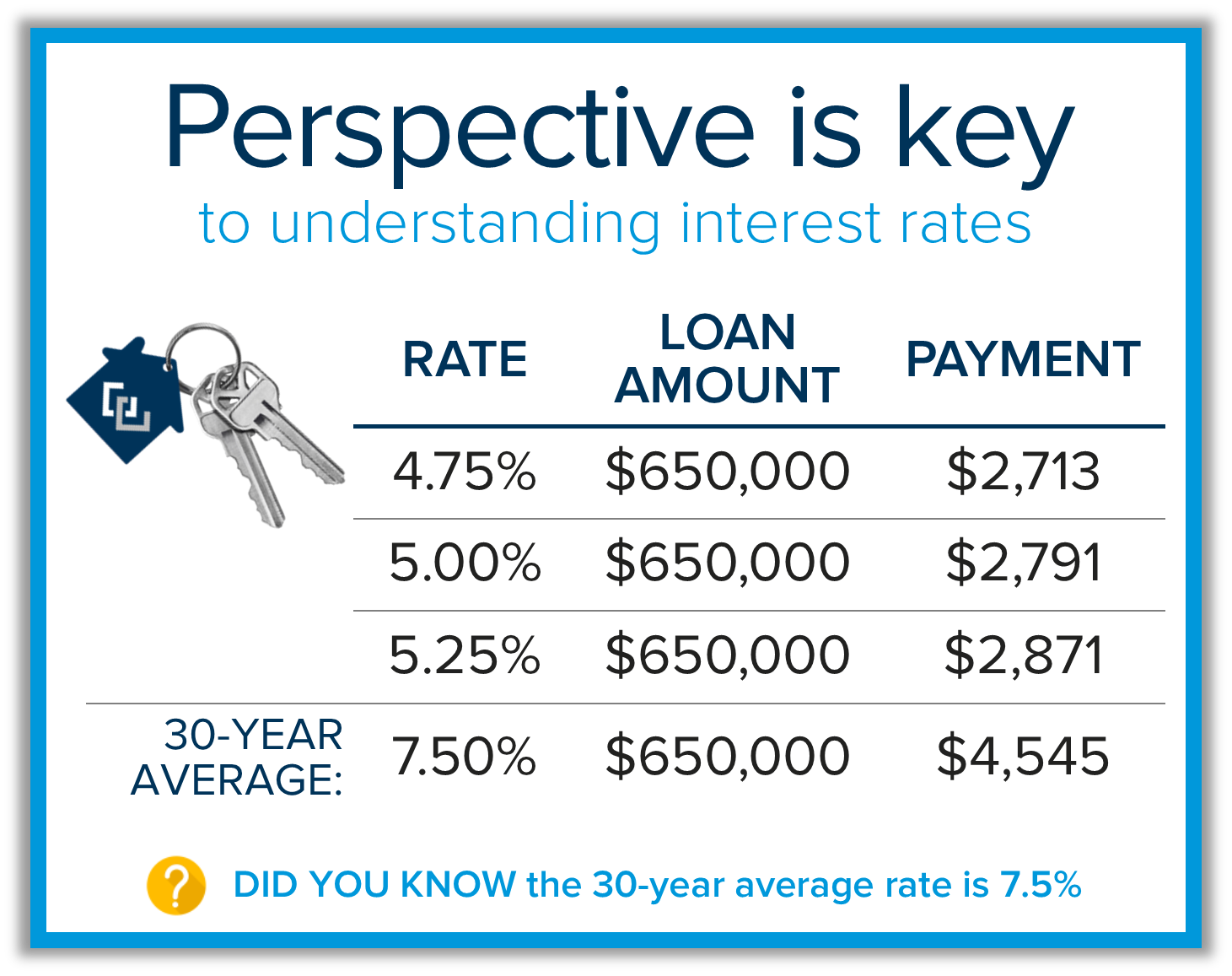

As we continue to examine the shift in the market, we must take a moment to take a deep dive into interest rates. Since the first of the year, long-term interest rates have increased 2.7% from 3.11% on 12/30/21 to the peak of 5.81% on 6/23/22, but have started to level out. On 8/4/22 rates found themselves at 4.99% which provided more opportunities for buyers and helped increase demand. These are the base rates that are released but can shift up based on the loan program or elements in the buyer’s application, like a credit score.

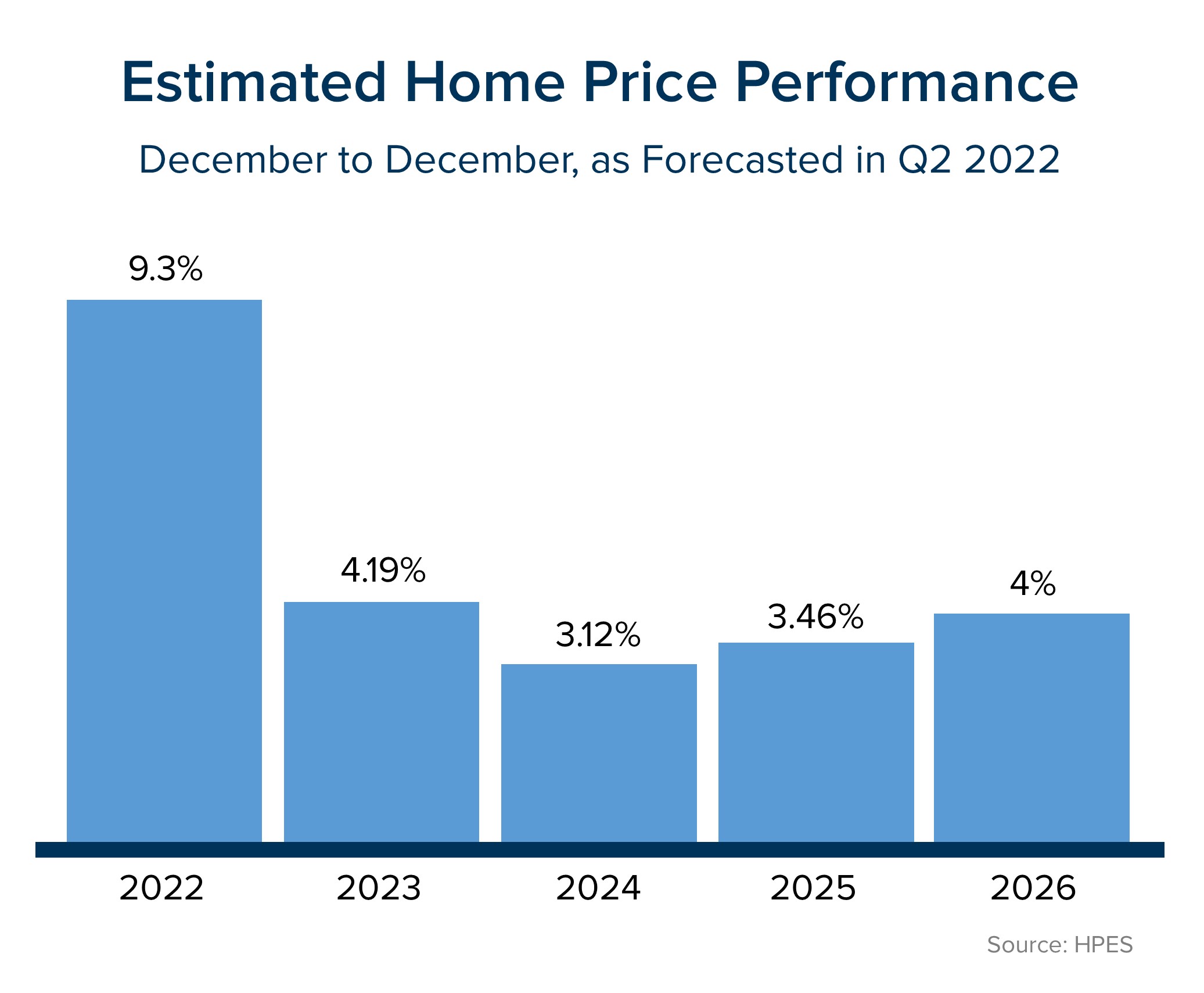

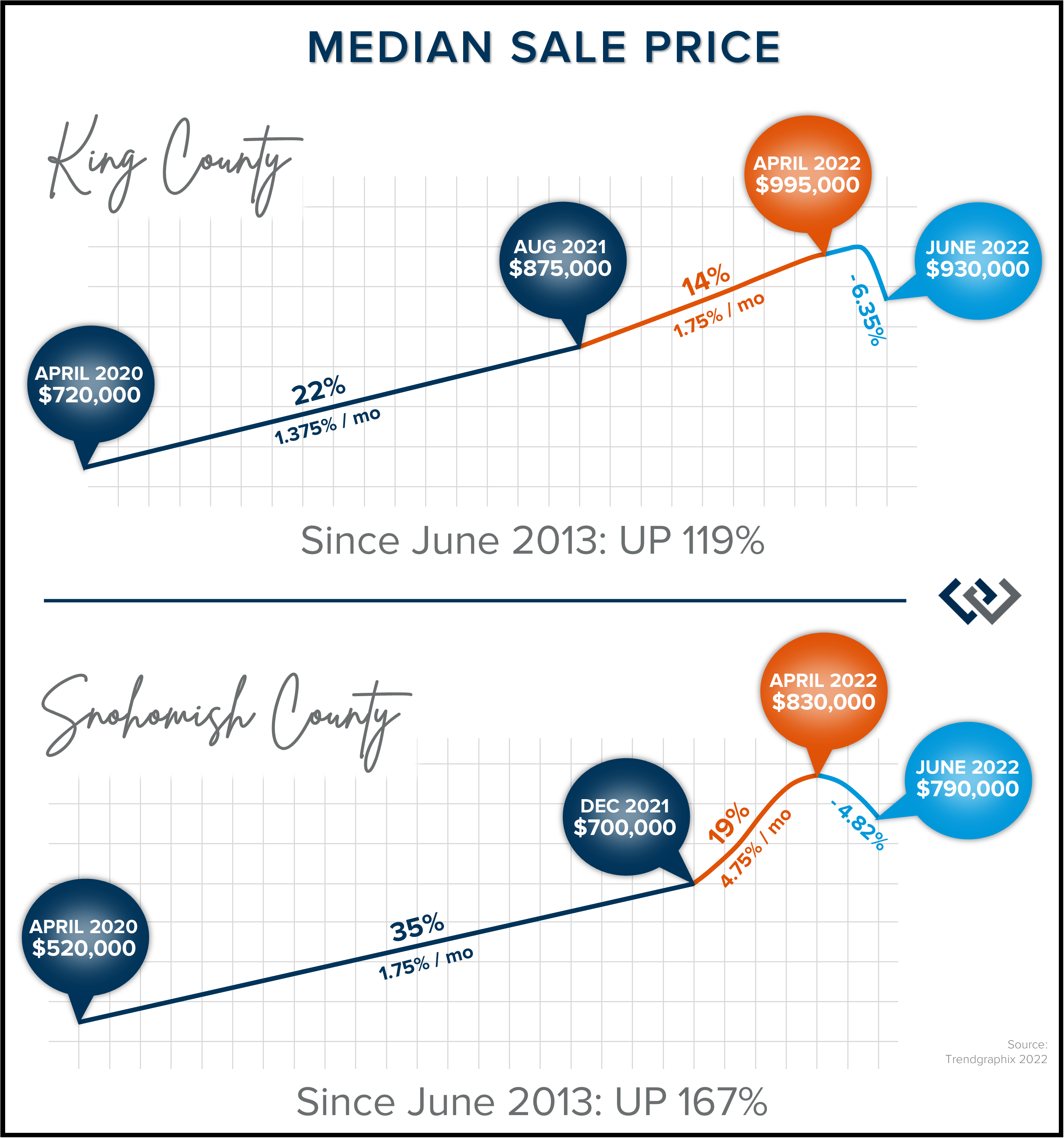

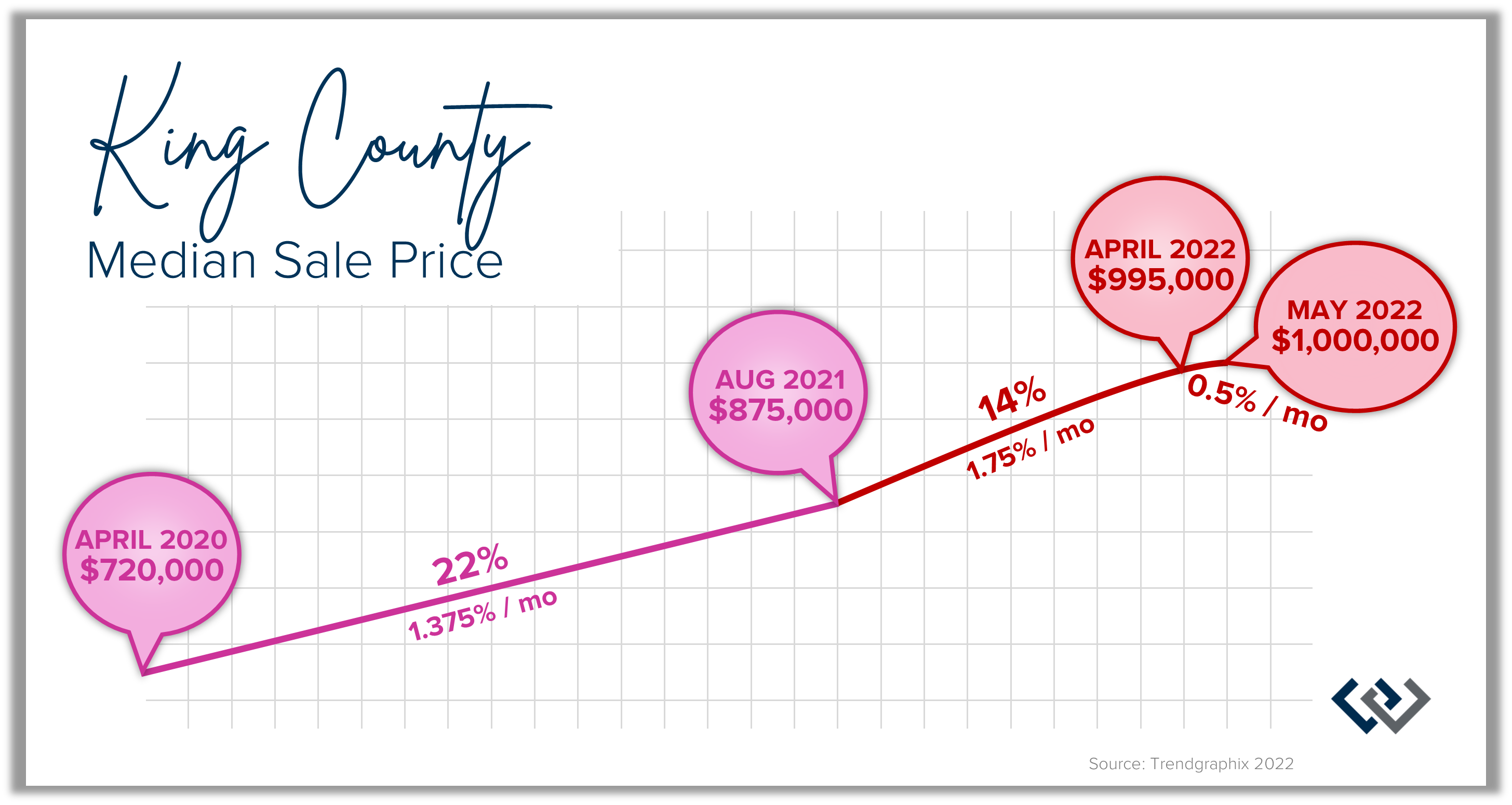

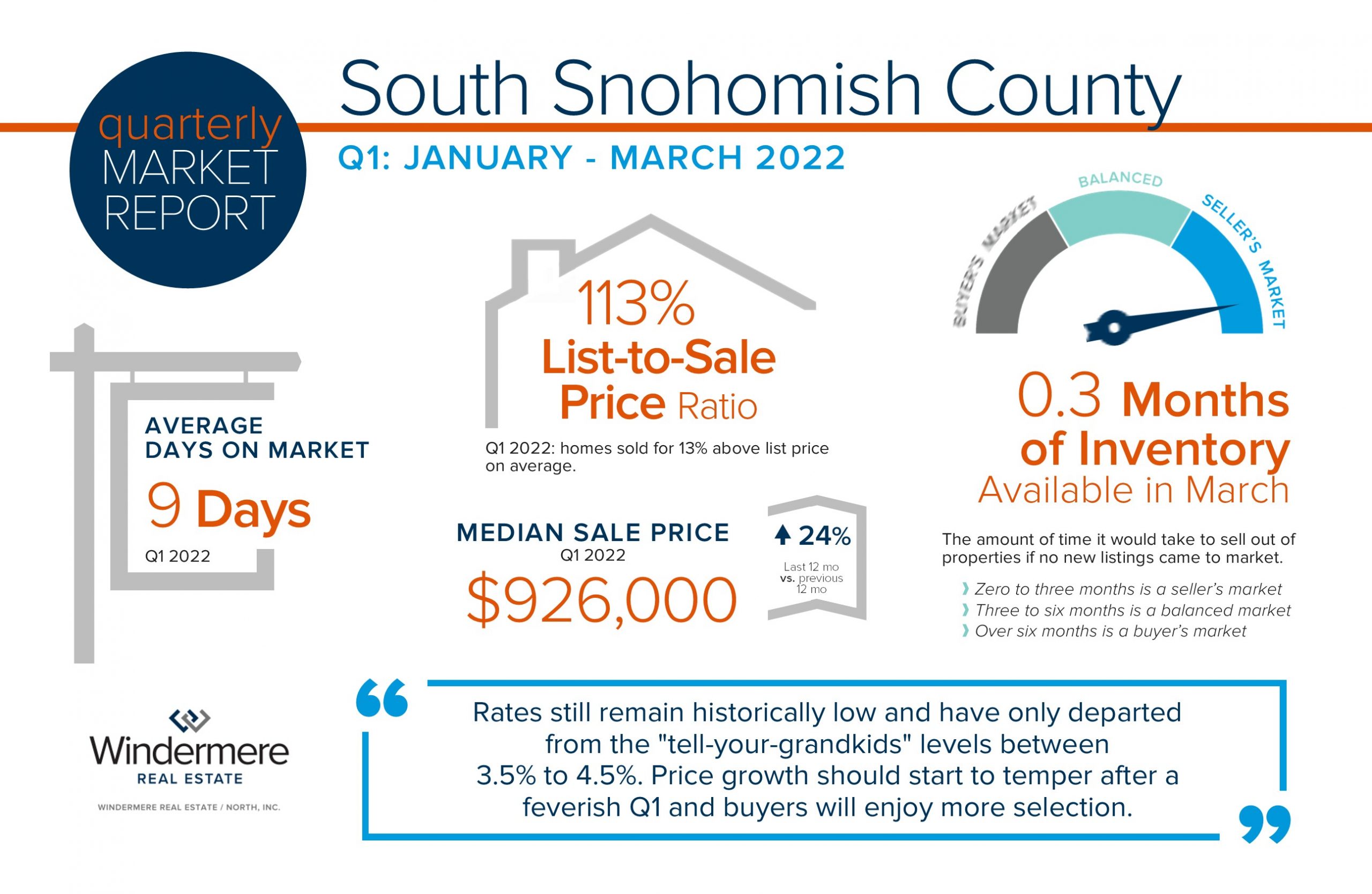

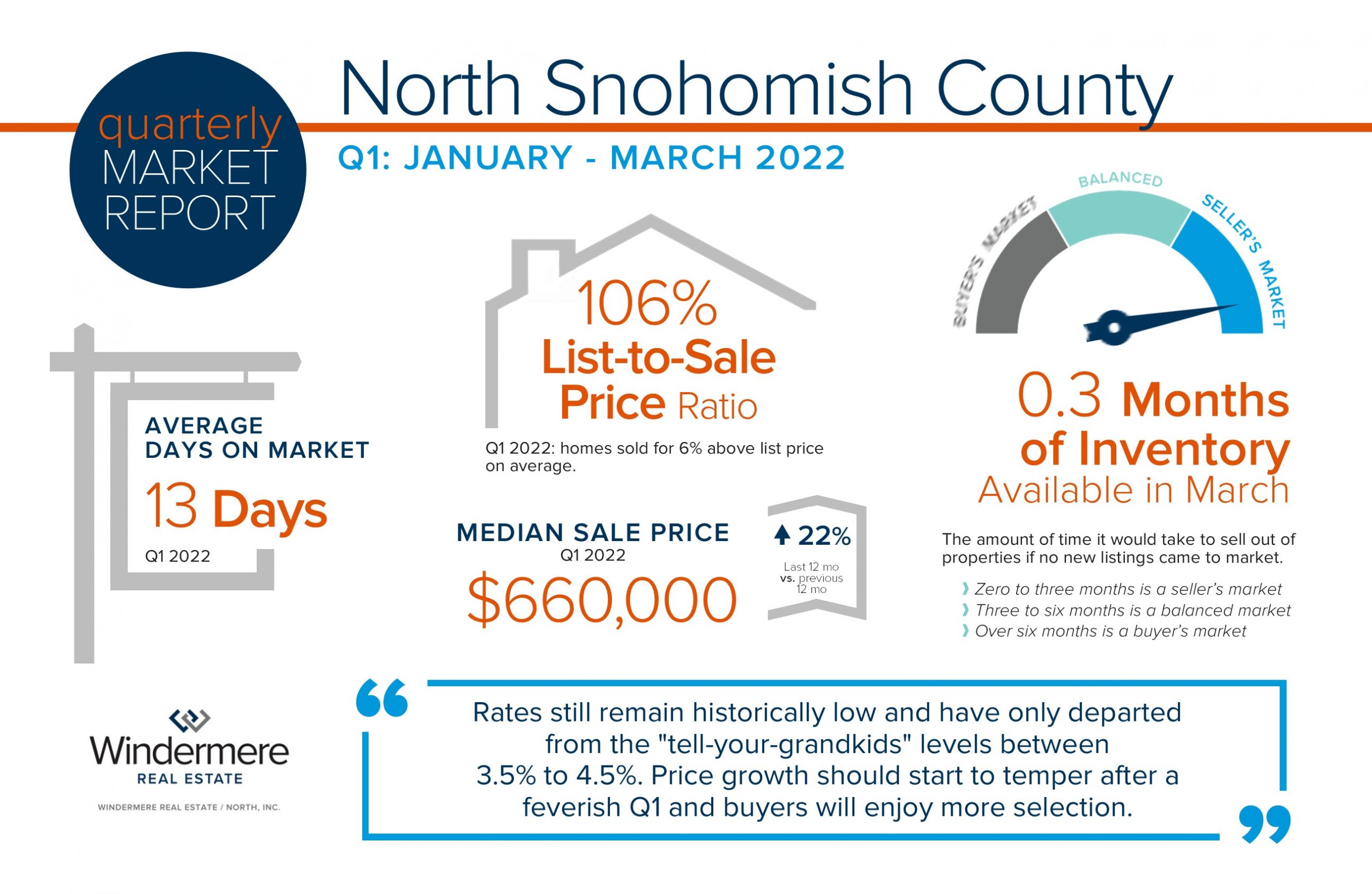

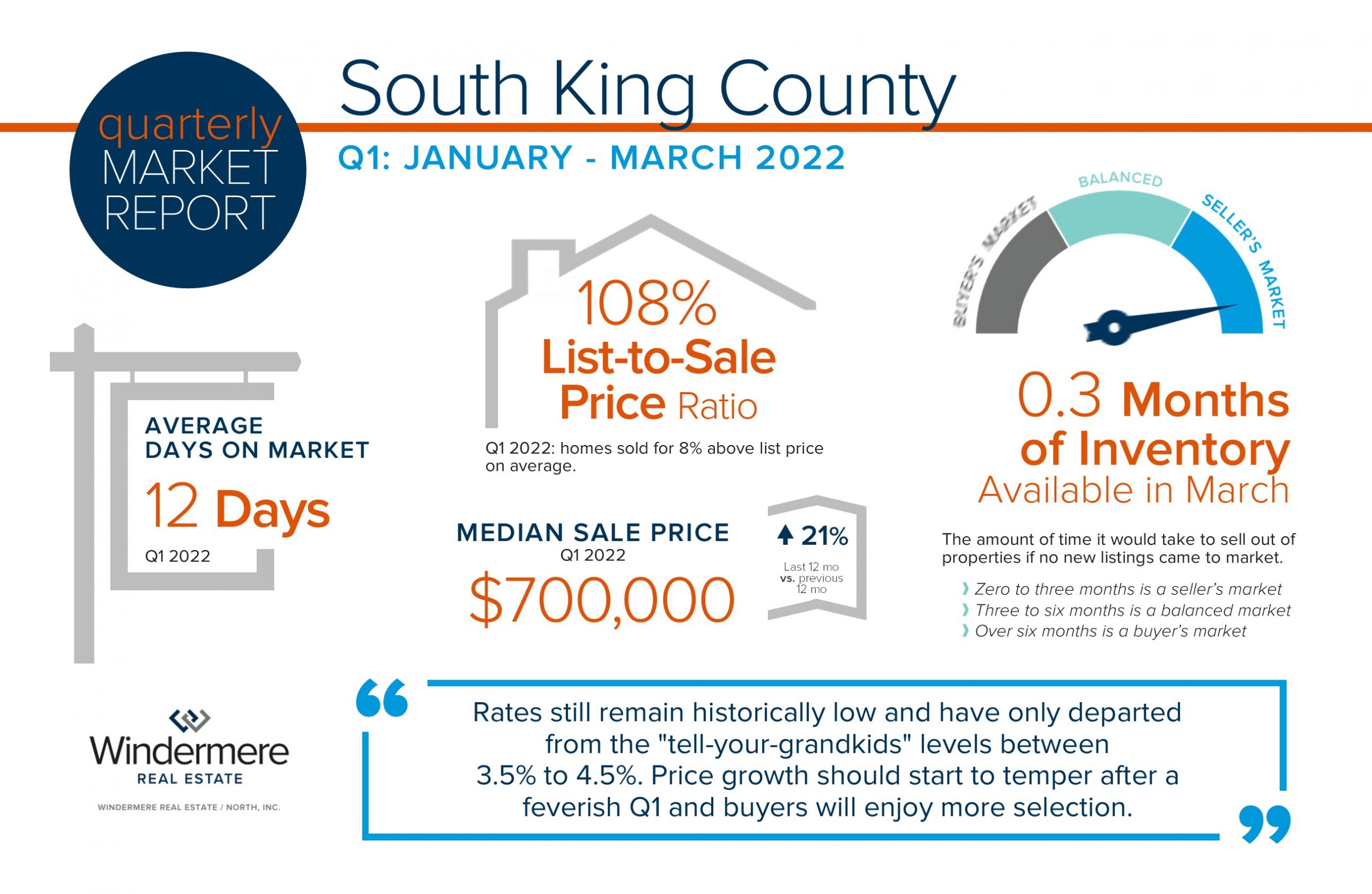

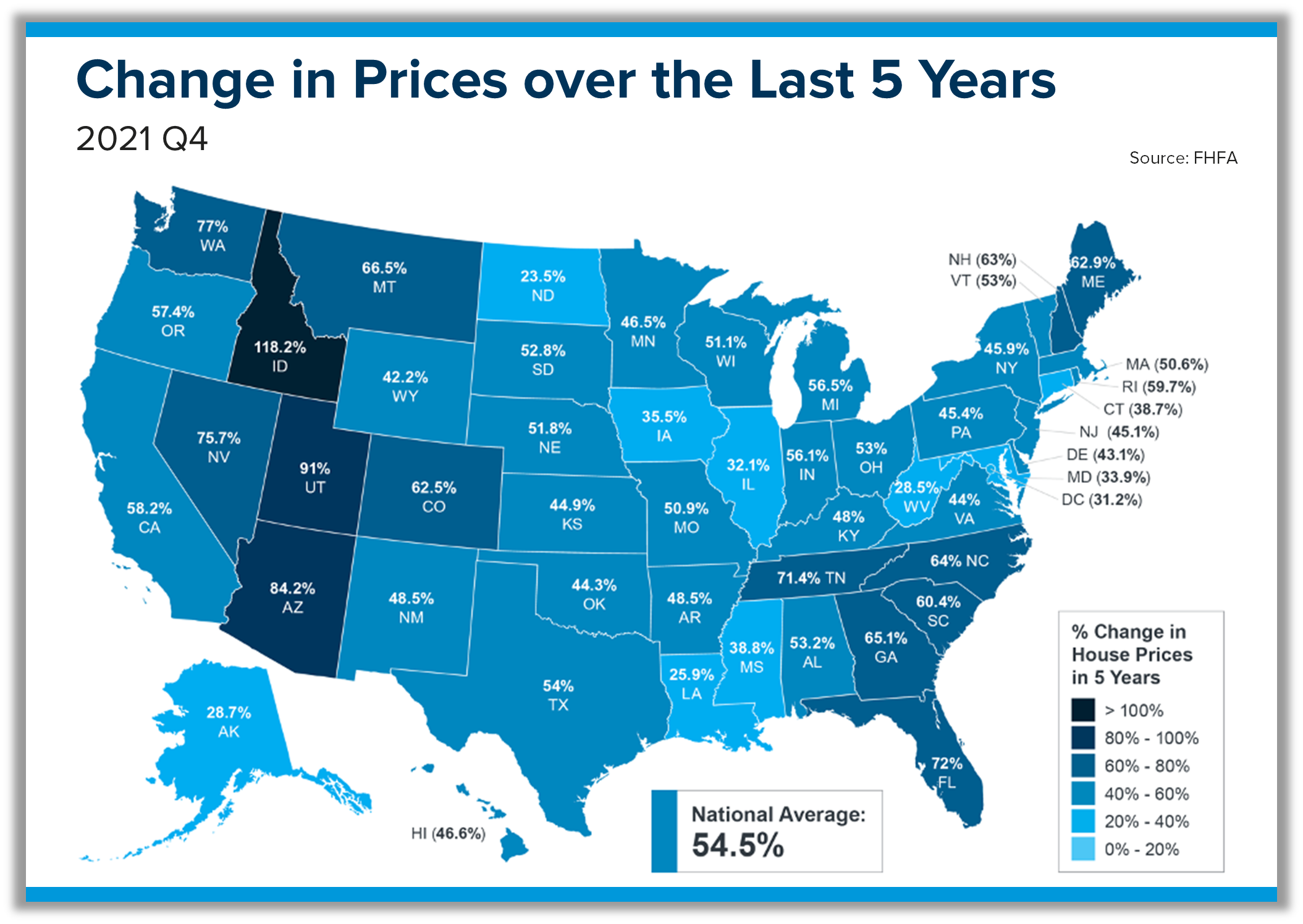

You see, affordability has been a challenge with the incredible price appreciation we have seen over the last two years. The median price is up 34% ($568,000 to $760,000) from July 2020 to July 2022 in Snohomish County and up 24% ($729,000 to $900,000) in King County. Average annual price gains are typically 3-5% making these last two years a time of significant growth. This is on top of 10 straight years of positive price growth. Homeowners are sitting on a ton of equity!

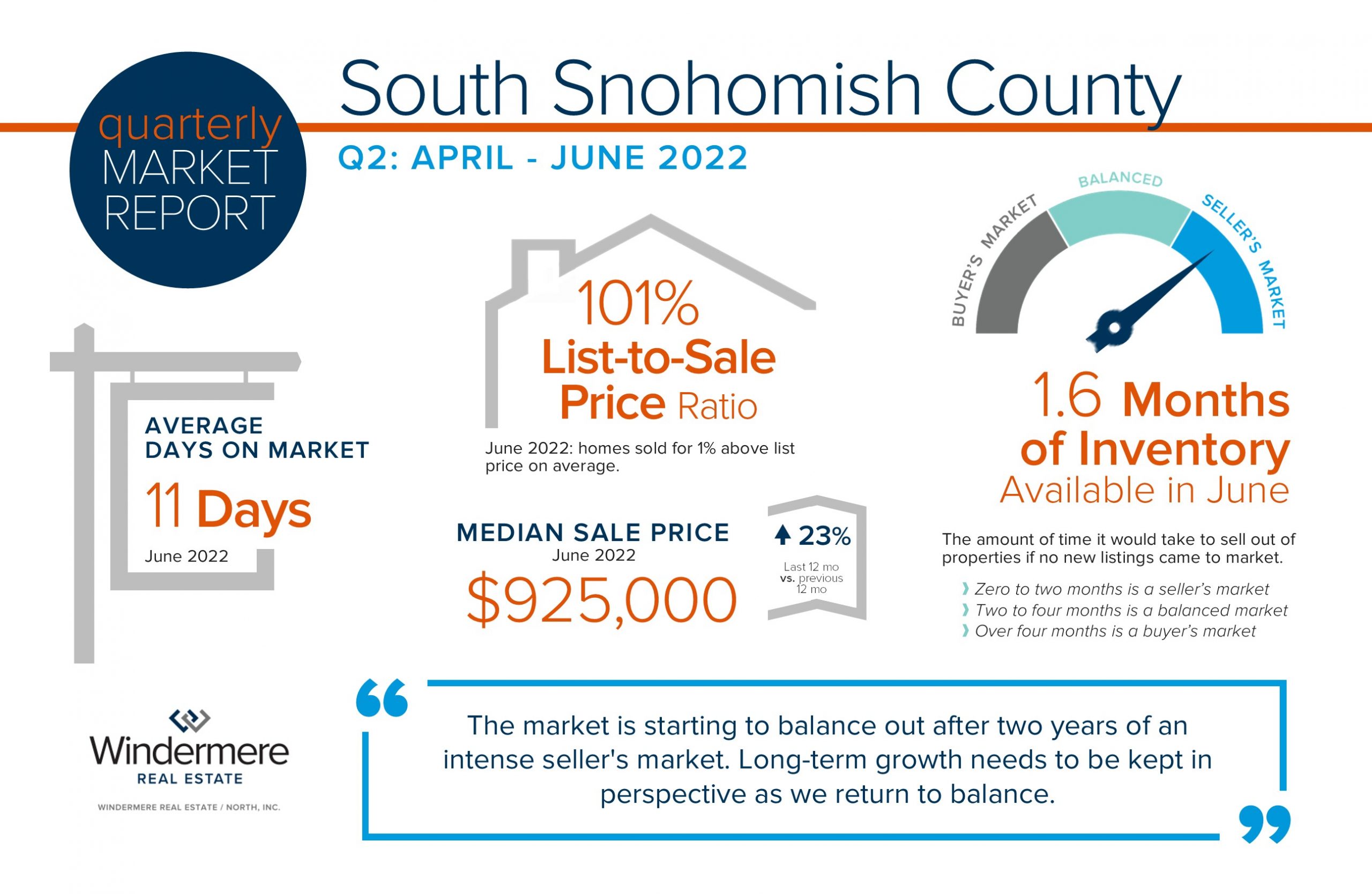

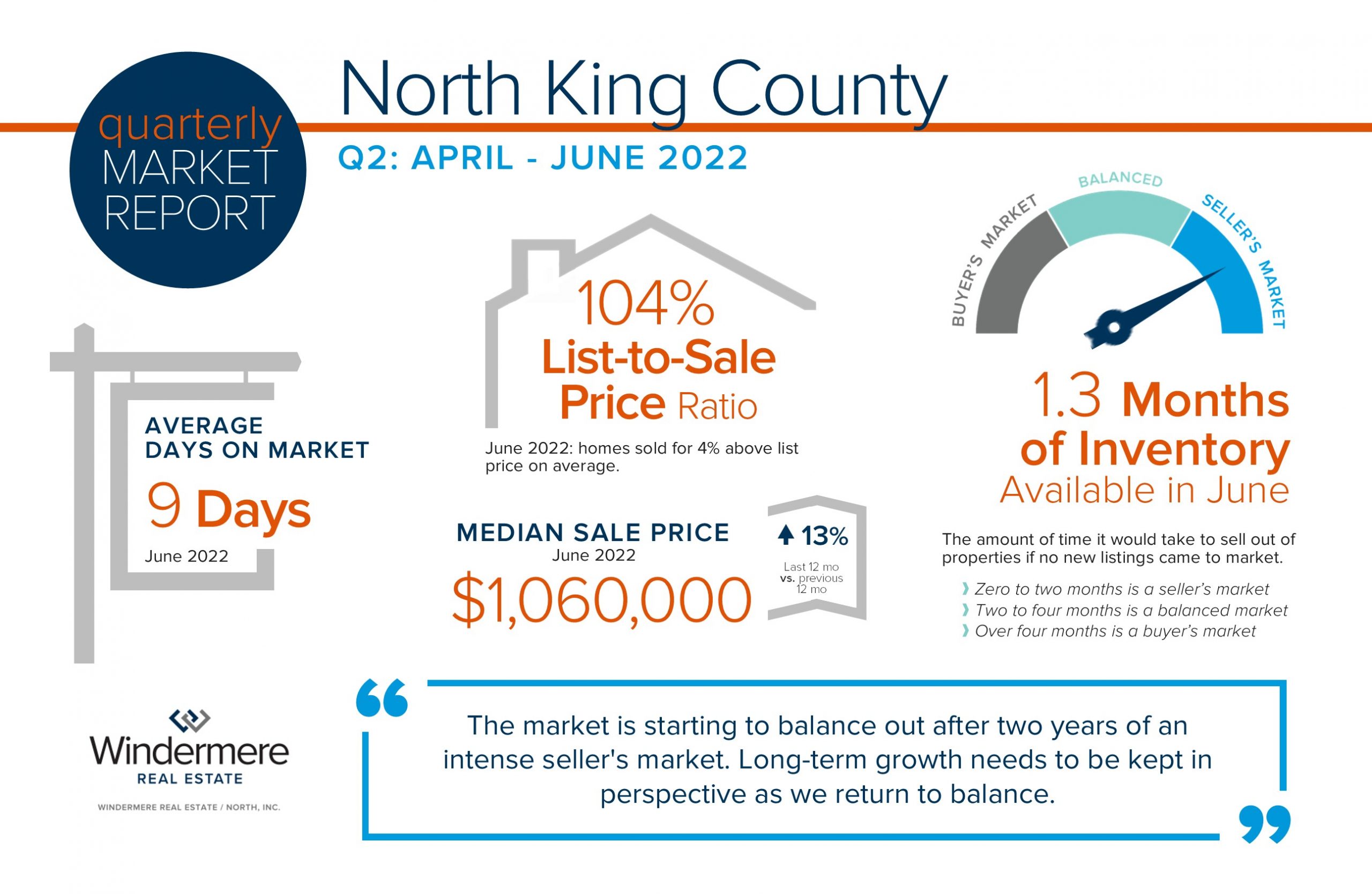

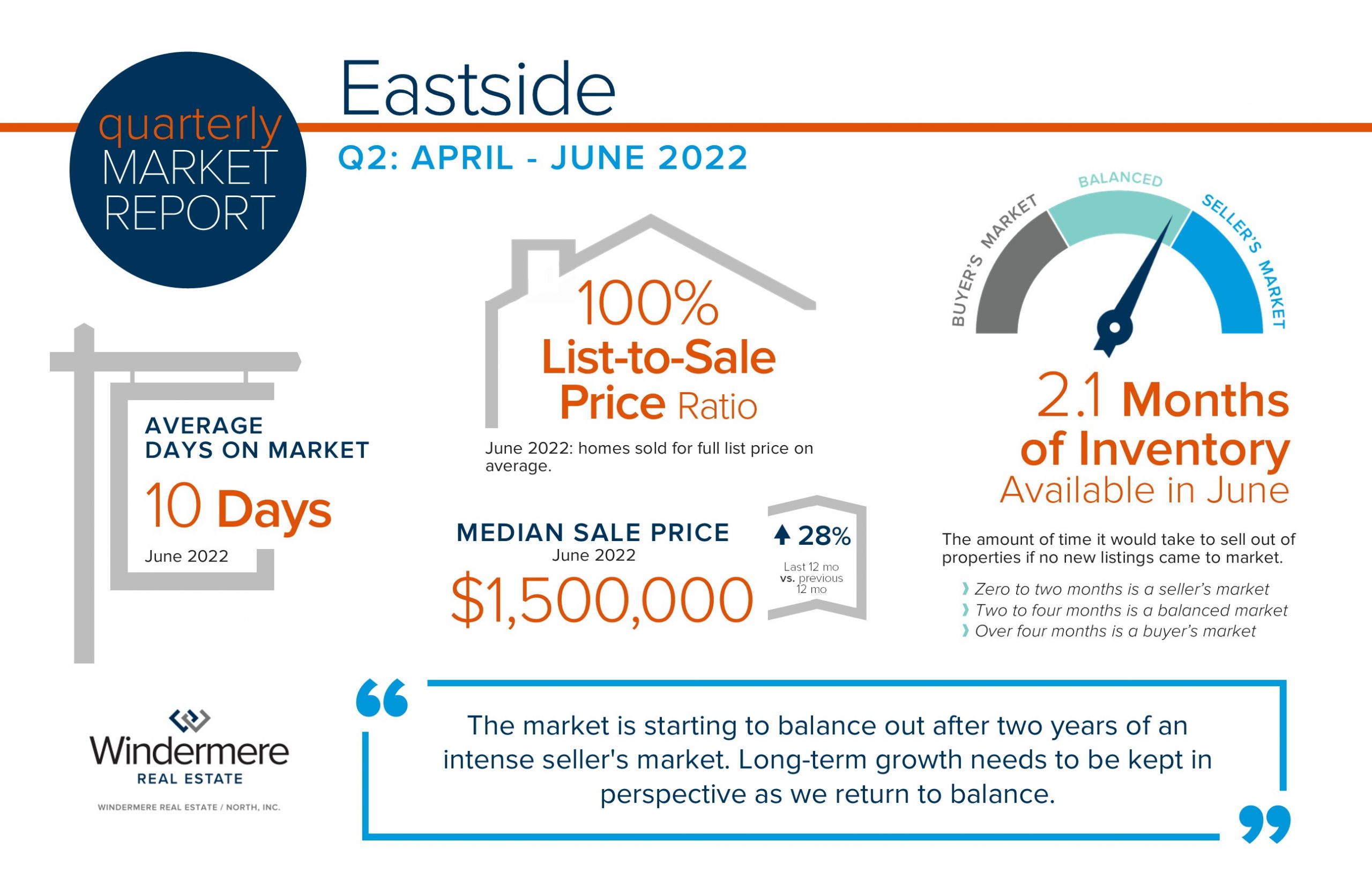

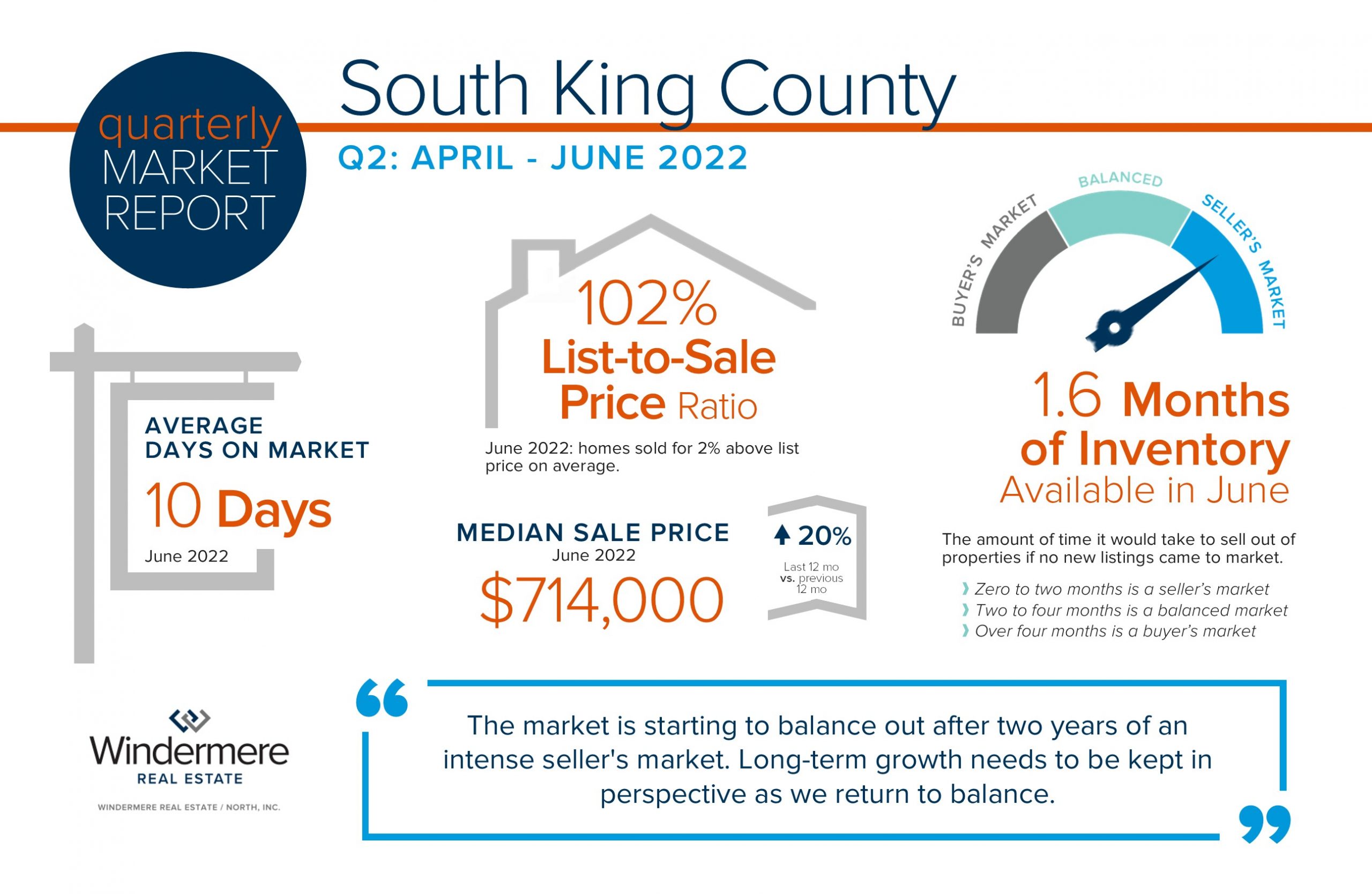

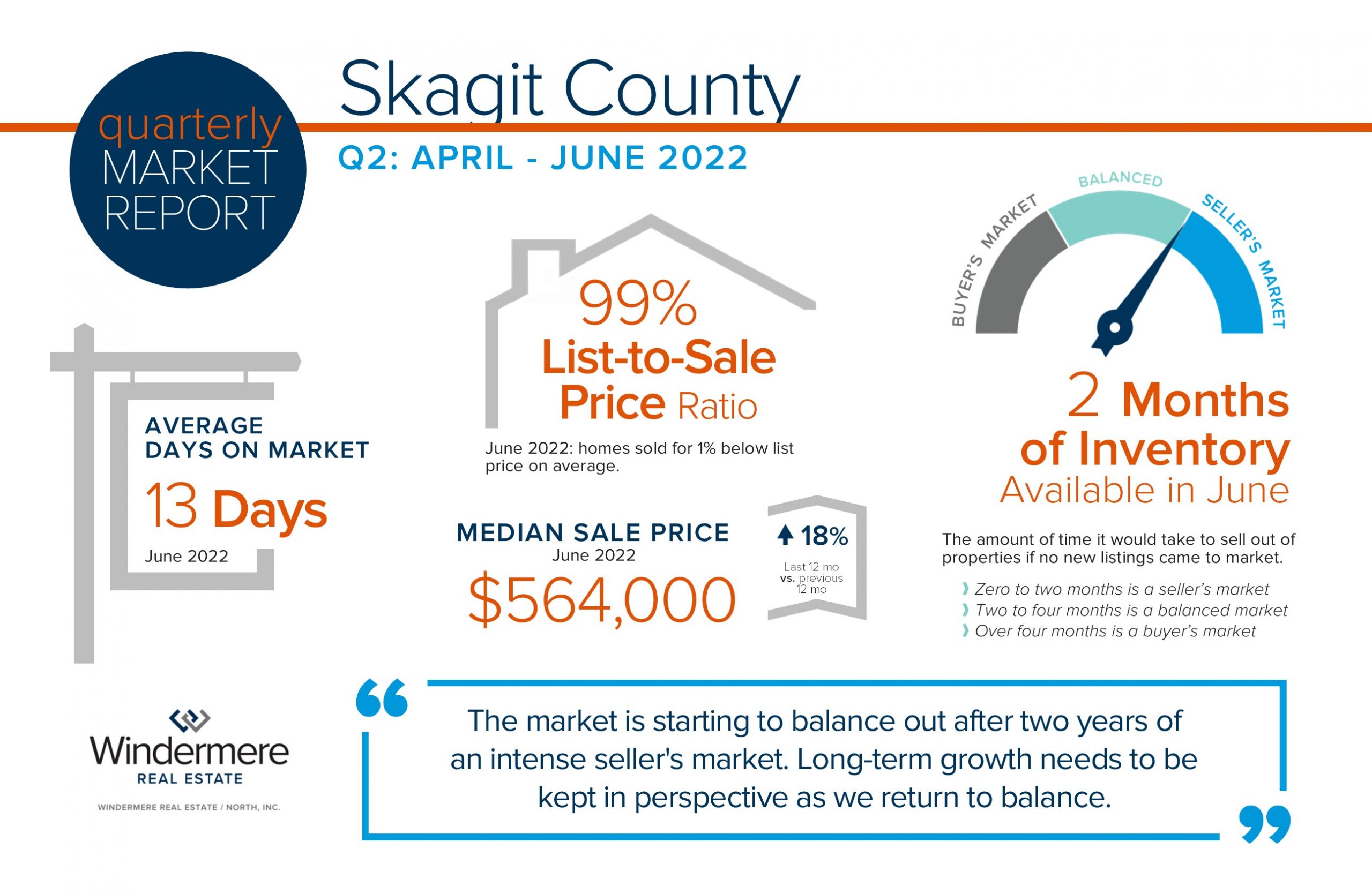

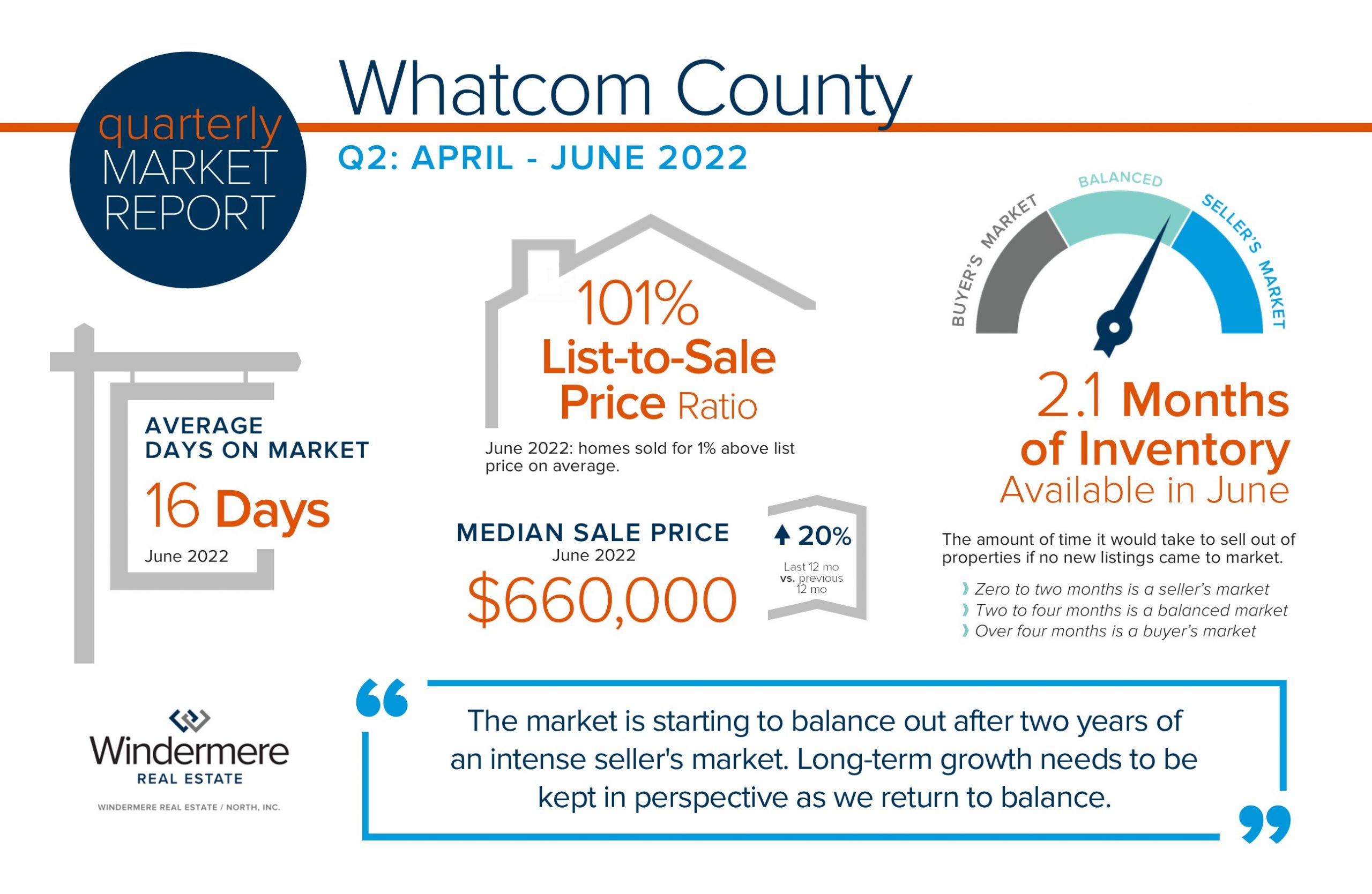

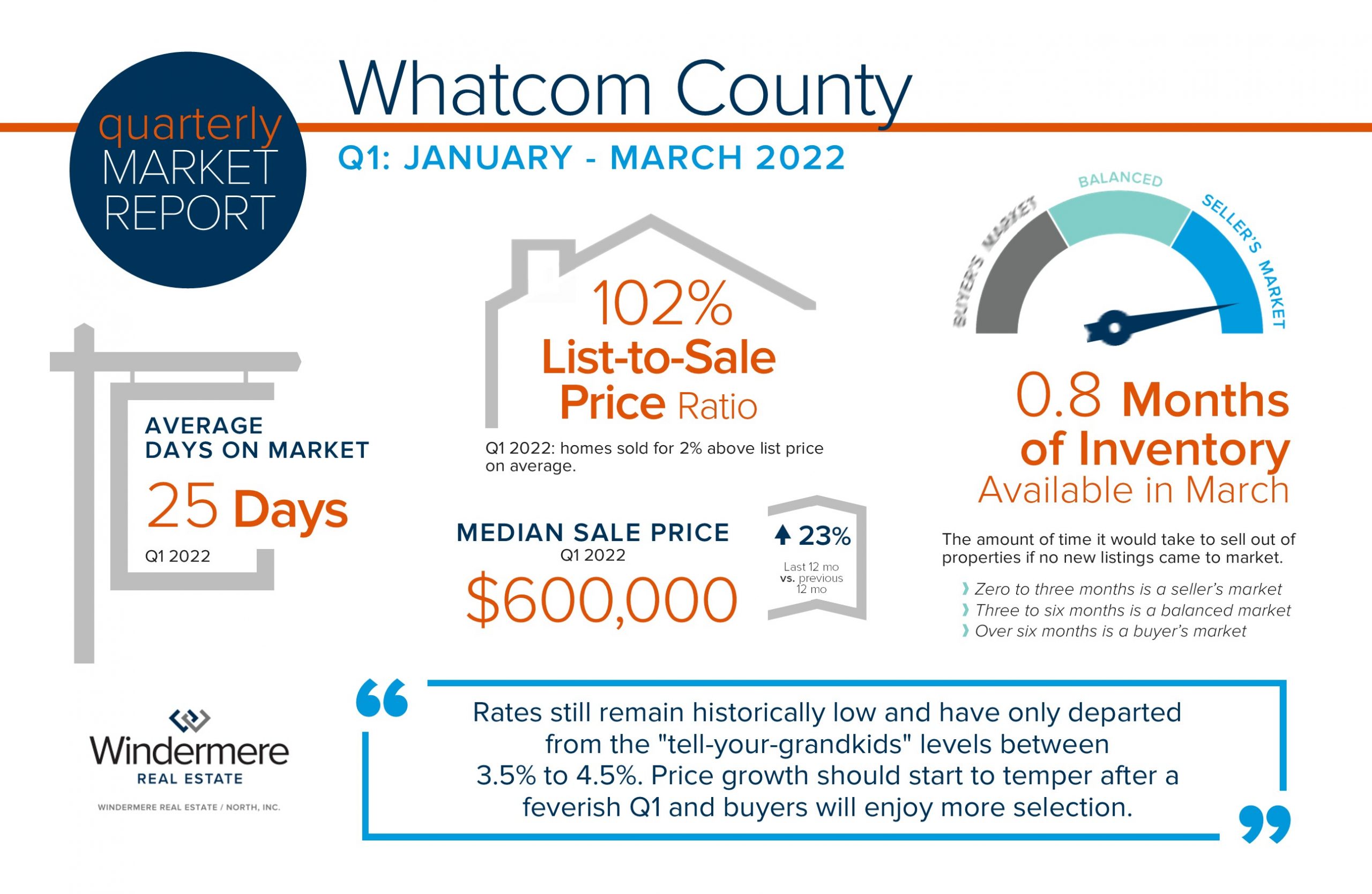

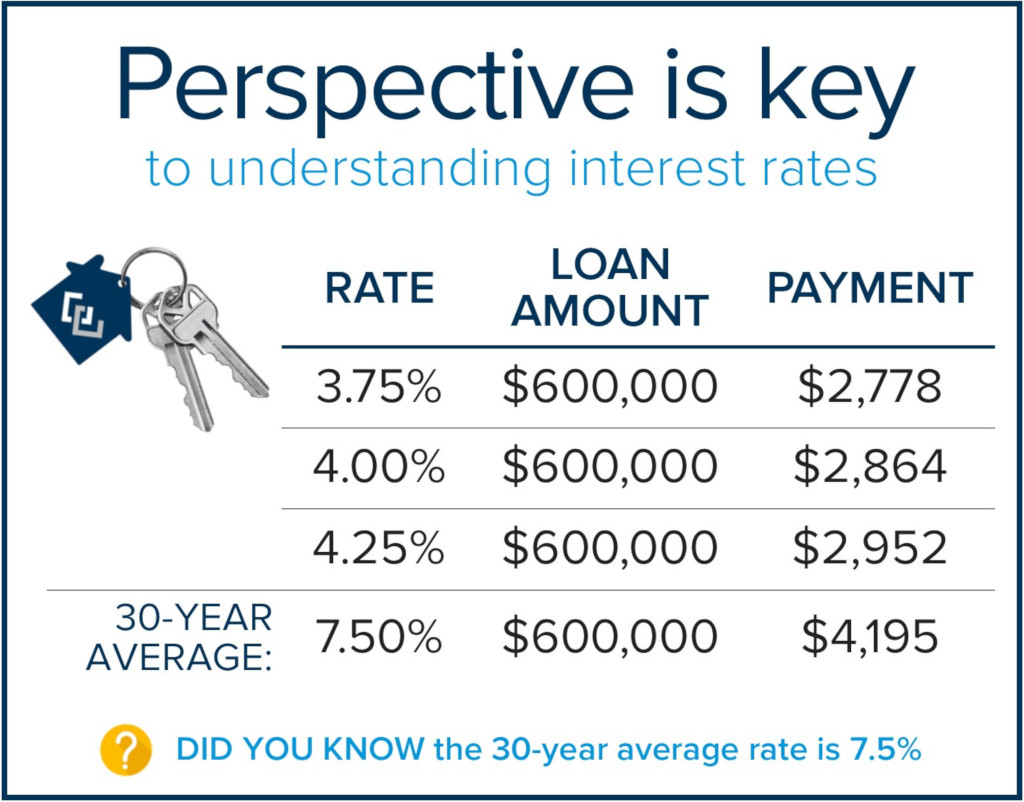

These recent extreme price escalations were directly connected to the historically low interest rates that were in the 3-4% starting in the spring of 2019 and lasted until the spring of 2022. To combat inflation the Fed made the move they’ve been talking about for some time and started to raise interest rates. This started to take shape in April, peaked in June, and has now started to stabilize as we head into the dog days of summer. As rates start to normalize it is putting downward pressure on the peak prices. Bear in mind that the average interest rate over the last 30 years is around 7.5% which we are well below. This low-rate environment was also coupled with a scarcity of inventory and now we are starting to see more selection and a shift from a sellers’ market (0-2 months of inventory) to a balanced market (2-4 months of inventory).

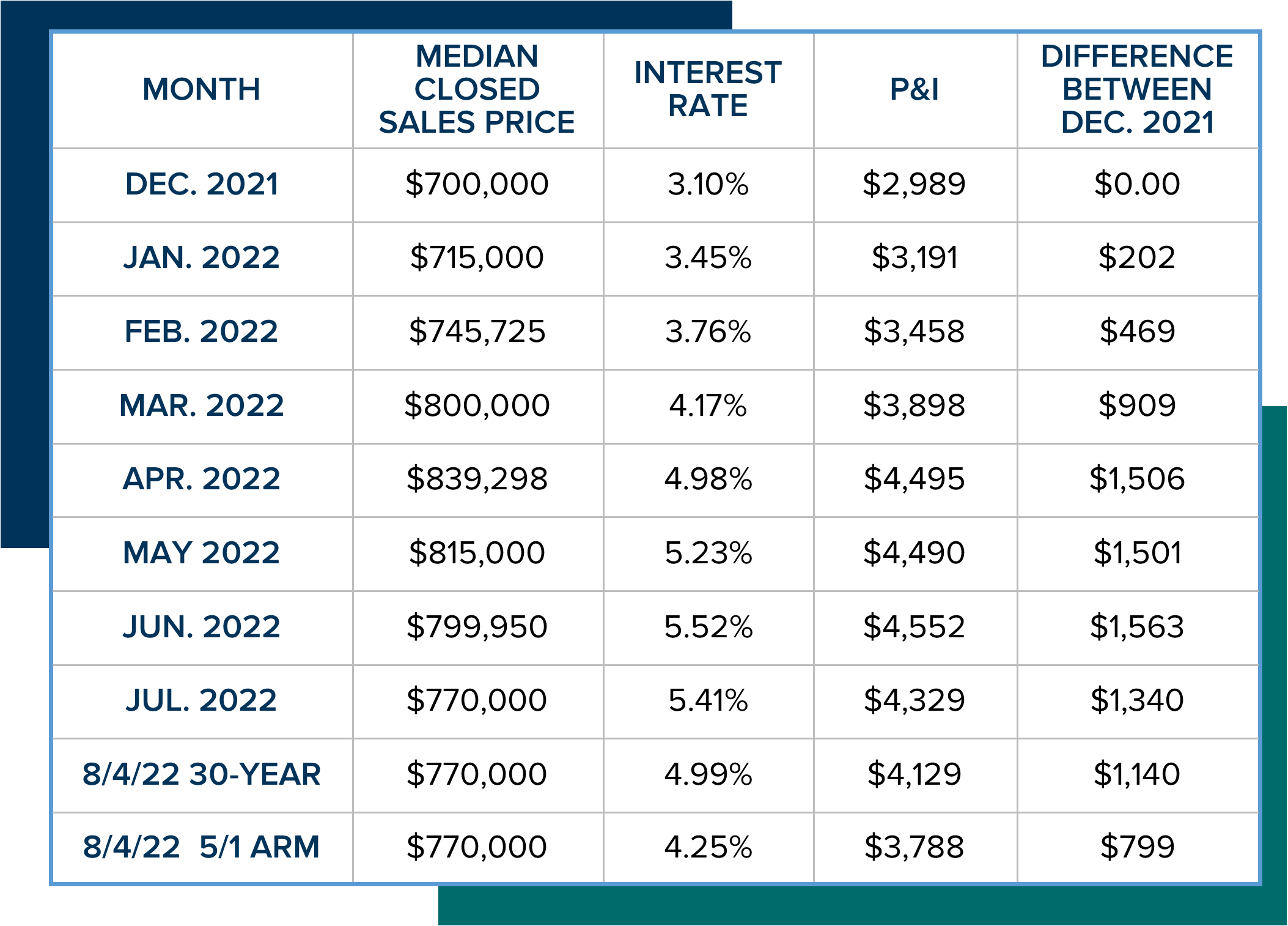

Buyers often choose their price point based on the monthly payment they will need to sustain throughout the term of their loan, not necessarily the highest price they are qualified for. If you look at the chart below you can easily see what buyers are needing to consider financially and how that would price them out of the higher price points. That has directed the demand to adjust to lower price points in order to provide a monthly payment that is sustainable and affordable. Hence, putting downward pressure on the peak prices we saw in spring 2022 when rates were in the 3-4% and there were only 2 weeks of available inventory in Snohomish and King counties. Now there is 2 months of available inventory for both counties, which is an indicator of a balanced market.

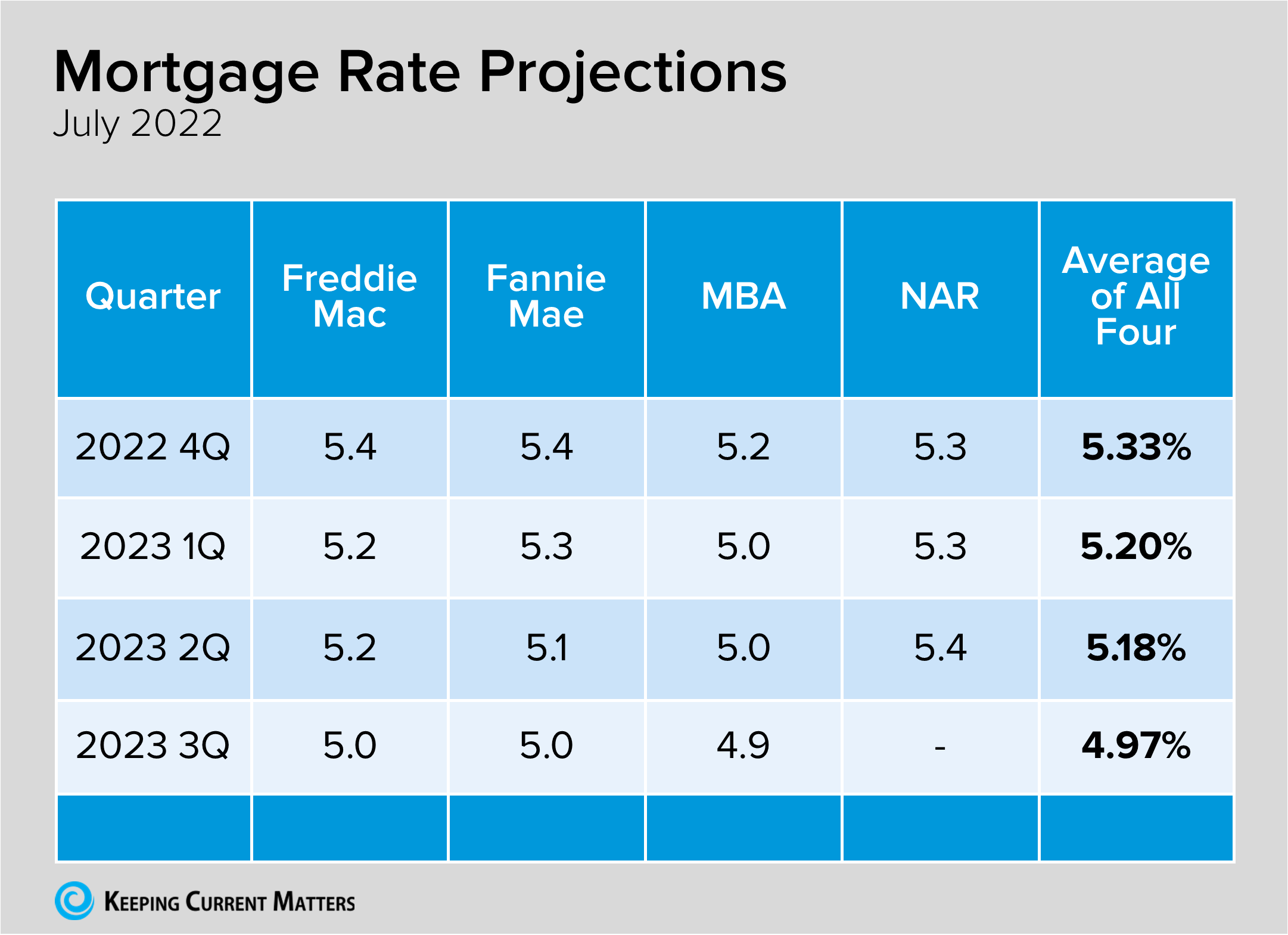

The sky is not falling, we are just adjusting to the new normal of interest rates and getting used to having additional selection and competition. Prices are still up significantly year-over-year and homeowners are sitting on a mound of equity built over the last decade. Prices have come off the peak of April 2022, but are starting to recalibrate in relation to the cost of debt service. We anticipate this correction to level out in the coming months. Experts are predicting rates to simmer in the 5% with the hopes of not entering into the 6% like we saw in June as the volatility of this adjustment was finding its way as a response to inflation.

It is also important to understand that mortgage rates are long-term rates and when you hear in the news that the Fed is going to hike interest rates to combat inflation, that it is often short-term rates they are referring to such as car loans, credit cards, and home equity lines of credit. The point of the short-term rate hikes is to get people to slow their spending and save more to hedge against inflation. In fact, the last short-term rate hike caused long-term mortgage rates to lower. Make sure you are consulting an expert and not just listening to the media.

I will continue to keep a close eye on rates, prices, and inventory so my clients are equipped with the most up-to-date information. We must understand all three of these elements are directly connected to each other and they will adjust and find balance. Our local job market is strong, home equity is high, interest rates are still well below the 30-year average, and there is a lot that is motivating the economy. While we may be experiencing a recession, we are not experiencing a dismal housing market. Sales are maintaining at the same level as 2018 and 2019 which were very strong years in real estate, but a bit less than the pandemic-fueled years of 2020 and 2021 that saw a reorganization of our communities due to the work-from-home phenomenon.

Real estate has always been a long-term hold investment and also the place you call home. It must be looked at from a financial perspective and a lifestyle one as well. We are starting to see some creative options in the market with rate buy-downs, even seller credits, and some buyers opting for ARMs (adjustable-rate mortgages) in order to get the payment that works for them. Please reach out if you have questions or are curious about how your goals relate to today’s market. It is always my goal to help keep my clients well informed and empower strong decisions.

In honor of Windermere’s 50th anniversary, we’ve set a goal to reach $50 million in total donations to the Windermere Foundation in 2022 for our 50 in 50 Campaign. To reach our goal, we need to raise $4 million in donations this year. So far this year, through the month of July, $2,011,963 in donations has been raised for the Windermere Foundation.

Our office is just finishing a Summer Food Drive that will help contribute to this total, but more importantly, will help keep the local food banks stocked. We have partnered with Volunteers of America of Snohomish County and they recently shared with us that their need is high due to the increase in the cost of groceries. We are always looking to direct our giving to areas of high need right in our own backyard. We will continue to support the food banks throughout the year with additional food drives around the holidays. Please let me know if you want to participate and I’ll help make that happen!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link